- 08-8363-4395

- info@sumtotalab.com.au

- 44 Nelson Street, Stepney SA 5069

- Mon-Fri: 10am to 5pm

"If you are planning to build, establish, grow and benefit from a small business, protecting your assets (and reading this book) should be one of your primary considerations.. Karen teaches this simple truth: own nothing yet control everything! Working with the SumTotal team you will be able to ethically quarantine your hard earned assets from creditors, competitors and the courts." — Harvee Pene

This is a call to arms for any business owner who is either doing so very well or is still so busy “making it” that protecting what they’ve earned, and what they’re going to earn is of secondary concern.

Protect Assets is essential reading for those that would hate to see all (or a significant chunk) of their life’s work be significantly impacted by tax, a poor decision, simple mistakes or complex errors. “It wasn’t my fault” doesn’t cut it anymore whether the blame lays with you, the business owner or a third party.

And this book will:

If you do have a care for the future, yours, your business’s, those you care about, Protect Assets will get you thinking but more importantly, get you acting on the important advice that all business owner’s need to know about.

Remember, they’re your assets, they’re worth protecting.

As members of Life Changing Accountants, we’ve made a public commitment to be driven by one thing:

MAKING AN IMPACT

An impact on the businesses and lives of our clients, and together with them an impact in our communities and our world.

Our commitment, not surprisingly, is a total commitment to stand by the results that we create for our clients where –

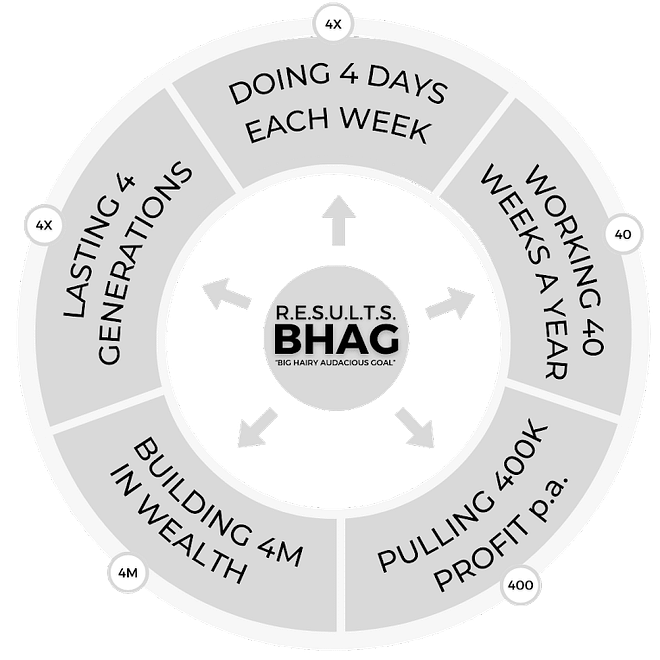

SO THAT we can proactively help our small business clients reach ‘THE R.E.S.U.L.T.S. BHAG aka Big Hairy Audacious Goal’ –

"I proudly belong to Life Changing Accountants, a group of 101 like-minded Accounting Firms who have each contributed to these books.

We chose collaboration over competition SO THAT we can each make more of an impact in our clients lives.

This is why you'll see a number of books with this same title, written in collaboration with my colleagues of the same heart. 101 Life Changing Strategies by 101 Life Changing Accountants.

Enjoy."

ABN: 47 149 891 508

Liability limited by a scheme approved under Professional Standards Legislation

Link to our Privacy Policy

Link to our Accessibility Statement

© All Rights Reserved.